Using analysis provided by MacroRisk Analytics, we have identified 10 stocks selected from the S&P 500 Index with positive returns year-to-date that have the highest and lowest return-to-risk ratios.

We frequently see stock rankings which show best and worst performers for different time periods in terms of return. We believe that it may be as important to rank investments in terms of return-to-risk ratio. This ratio identifies how much return an investment provided per unit of risk taken. For instance, if investment A had a return of 10% and a standard deviation (risk) of 20%, its return-to-risk ratio would be 0.5. Suppose instead, we consider investment B which had a return of 10% and a standard deviation of 15%. Investment B’s return-to-risk ratio is 0.67. In other words, investment B might be viewed as a better investment in this scenario because it had a higher return-to-risk ratio. Even though both investments had the same return (10 %), investment B had a lower risk as measured by standard deviation.

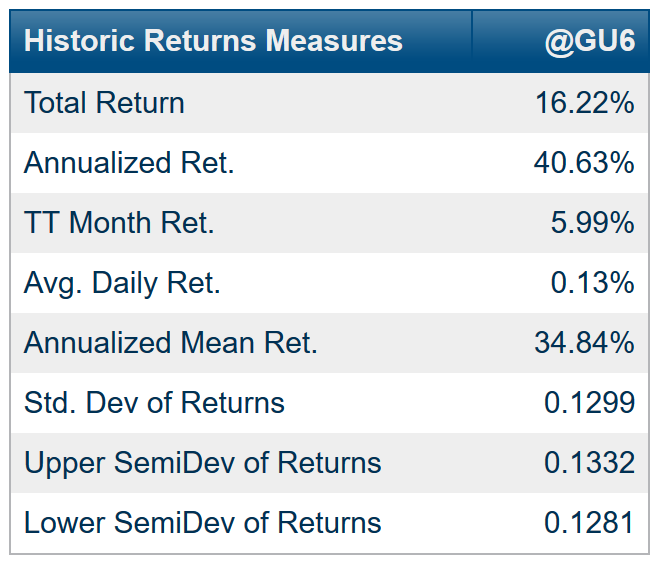

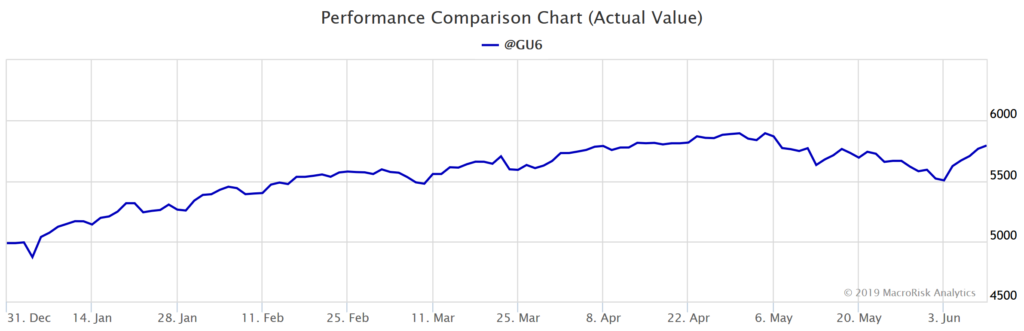

Let’s take a look at a common performance benchmark, the S&P 500 Total Return Index and see how it has performed so far this year (12/31/18 through 6/10/19). We like this benchmark because it includes both price change and dividends paid to measure total return whereas the S&P 500 Index only shows the price change (or a fraction of the return that an investor would receive were he or she to invest in the index).

The year-to-date return (through 6/10/19) for the S&P 500 Total Return Index is 16.22%. Quite a stellar run coming after a dismal performance in the fourth quarter of 2018 during when this index dropped by 13.52%.

As we did earlier with our two hypothetical investments, to calculate the return-to-risk ratio for the index, we take the annualized mean return (34.84%) and divide by the standard deviation (12.99% annualized) year-to-date. The return-to-risk ratio is 2.68 (= 34.84% / 12.99%).

Now, let’s take a look at the 10 stocks out of the S&P 500 with positive returns year-to-date that have the highest return-to-risk ratios. With the help from MacroRisk Analytics, this can be done quickly using the screening tool:

The best performer year-to-date in terms of return-to-risk ratio is Tyson Foods Inc. which is in the consumer staples sector.

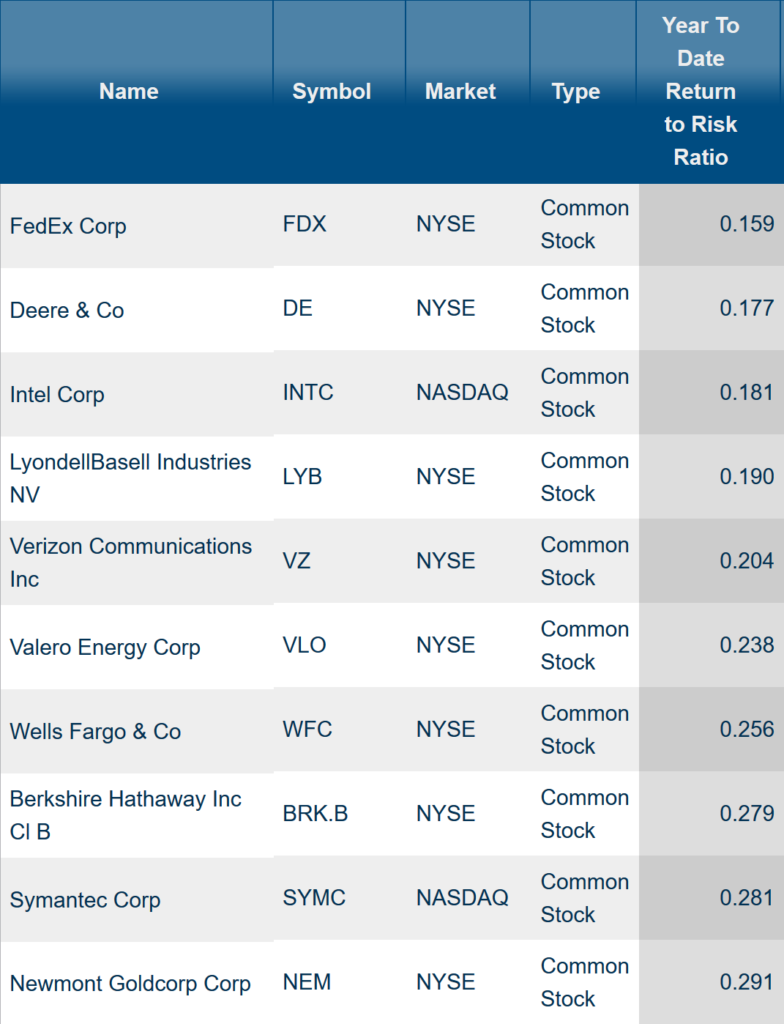

Using the MacroRisk Analytics screening tool, we also identified the 10 stocks out of the S&P 500 with positive returns that have the lowest return-to-risk ratios year-to-date:

Out of S&P 500 companies with positive return year-to-date, the worst performer in terms of return-to-risk ratio is FedEx Corp which is in the Industrials sector.

The goal of this post was to show companies that have provided the highest and lowest return per unit of risk taken (focusing only on those companies had positive returns year-to-date). Of course, this information is historic and in no way should be considered indicative of the future performance. Nonetheless, it might be worthwhile to be aware of these companies and try to understand why these companies have performed the way they did. In our upcoming blog posts, we will dive into some of the companies shown in this post using MacroRisk Analytics software.

If you would like to check out the tools provided by MacroRisk Analytics, click here.