The recent economic shutdown has caused the U.S. unemployment rate to skyrocket making it the most significant economic factor since June of 2020 according to the 18-factor MacroRisk Analytics® model. Financial advisors need to pay special attention to the unemployment rate and understand which stocks are expected to benefit from a decrease or an increase in the unemployment rate and potentially adjust the portfolios of their clients accordingly.

Using the MacroRisk Analytics® platform, this post will present 10 NASDAQ-100 Index stocks that are expected to benefit from a decrease in the unemployment rate and 10 NASDAQ-100 Index stocks that are expected to benefit if the unemployment goes up.

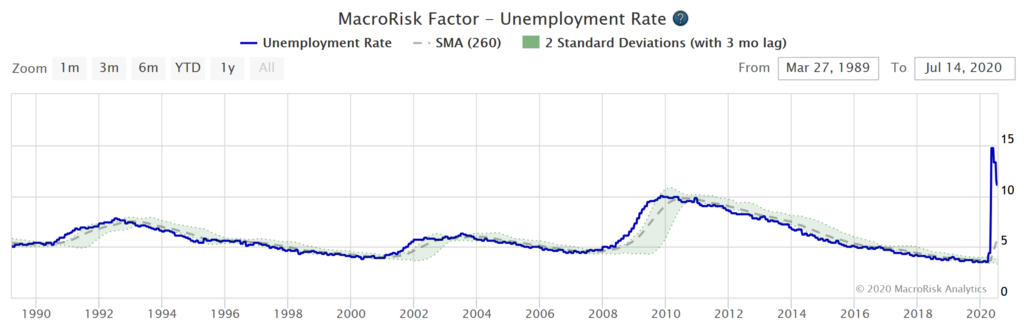

The graph below shows the unemployment rate from 1989 through July 14, 2020, and the Covid-related spike in the unemployment is much greater than the one during the 2008-09 market crash. The green bands around the unemployment rate show the expected unemployment range given its recent movement at the time.

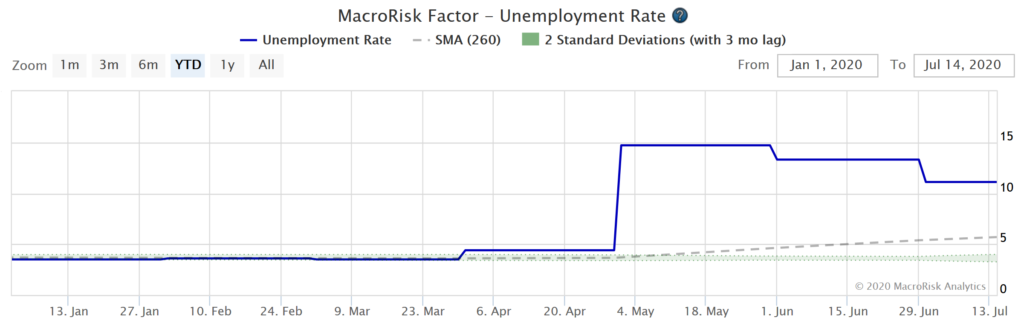

Zooming in to year-to-date unemployment rate, we can see just how much above the unemployment rate is compared to the upper bound of the green bands which correspond to the expected range of the unemployment rate based on its recent history (the green bands correspond to two standard deviations around the moving average).

Looking at the MacroRisk’s snapshot below of where the economic factors stand relative to their recent history as of 7/14/2020 clearly shows that the unemployment rate exhibits the most volatility relative to its moving average. The graph below shows how many standard deviations away a factor is from its moving-average. Red factors, such as the unemployment rate, are outside the two standard-deviation range denoted by the dashed lines.

With the unemployment rate factor being so significant in mind, using the MacroRisk Analytics® platform, we present a list of NASDAQ-100 Index stocks that are expected to benefit from a decrease in the unemployment rate and vice versa. These stocks are expected to have the biggest portion of their economic risk correspond to unemployment and where the stocks’ sensitivities to unemployment are negative as denoted by negative signs in the table below (i.e., expected to benefit from a decrease in the unemployment rate).

| Name | Symbol | Unemployment as a Proportion of Economic Risk as of 7/14/2020 |

| Amgen Inc | AMGN | -5.1% |

| Gilead Sciences Inc | GILD | -4.5% |

| Walgreens Boots Alliance Inc | WBA | -4.4% |

| Vertex Pharmaceuticals Inc | VRTX | -3.3% |

| Intuitive Surgical Inc | ISRG | -3.2% |

| Regeneron Pharmaceuticals Inc | REGN | -3.1% |

| Biogen Inc | BIIB | -3.0% |

| Incyte Corp | INCY | -2.6% |

| Lam Research Corp | LRCX | -2.5% |

| PACCAR Inc | PCAR | -2.2% |

Below is a list of 10 NASDAQ-100 Index stocks that are expected to benefit from an increase in the unemployment rate (i.e., these stocks are expected to have the highest positive sensitivity to the unemployment rate as a percentage of their economic risk).

| Name | Symbol | Unemployment as a Proportion of Economic Risk as of 7/14/2020 |

| Facebook Inc | FB | 8.4% |

| eBay Inc | EBAY | 5.1% |

| CoStar Group Inc | CSGP | 4.9% |

| Copart Inc | CPRT | 4.7% |

| Cintas Corp | CTAS | 4.4% |

| Liberty Global plc | LBTYK | 4.3% |

| NXP Semiconductors N.V. | NXPI | 4.1% |

| Adobe Systems Inc | ADBE | 4.0% |

| Liberty Global plc cl A | LBTYA | 3.9% |

| PayPal Holdings Inc | PYPL | 3.5% |

With the economy opening up, more and more people are expected to return to work which would drive the unemployment down. However, there exists a risk of a second wave of COVID-19 infections which might cause the unemployment to increase if similar shutdown measures are implemented.

You can find the economic exposures (such as the unemployment rate discussed in this post) of thousands of stocks, mutual funds, ETFs, and other assets using The Economy Matters® reports provided by MacroRisk Analytics®.

Some of the MacroRisk Analytics® analysis has been utilized by the Rational Equity Armor Fund (ticker: HDCTX) starting in December of 2019. For more information about the fund, click here.

Mr. Rolland Harris assisted with the preparation of this post.